Corporate Governance

- Basic Policy

- Management System

- Business Operation System

- Board of Directors

- Executive Nomination Meeting

- Executive Compensation Meeting

- Effectiveness of the Board of Directors: Evaluation Results

- Approach to the CEO Succession Plan

- Executive Officer Training

- Outside Directors, and Outside Auditors

- Compensation for Directors

- Preventing Conflicts of Interest

- Auditing by Corporate Auditors

- Auditing

- Internal Control

- Internal Control System Related to Financial Reporting

- SUBARU Group Governance

- Cross-Shareholding

Basic Policy

SUBARU has articulated the vision ’Delivering happiness to all” and works on the enhancement of corporate governance as one of the top priorities of management in order to gain the satisfaction and trust of all its stakeholders by achieving sustainable growth and improving its corporate value over the medium to long term.

- 〈Vision〉

- Delivering happiness to all

- 〈Value Statement〉

- ’Enjoyment and Peace of Mind”

- 〈Corporate Statement〉

- We aim to be a compelling company with a strong market presence built upon our customer-first principle.

SUBARU clearly separates the function of decision making and the oversight of corporate management from that of the execution of business operations, and aims to realize effective corporate management by expediting decision making. In addition, SUBARU seeks to ensure proper decision making and the oversight of corporate management and the execution of business operations as well as enhance its risk management system and compliance system through the monitoring of its management and operations and advice provided by outside officers. We also implement proper and timely disclosure of information in order to improve the transparency of management. SUBARU has created the Corporate Governance Guidelines with the objective of clarifying the basic concept, framework, and operating policy of its corporate governance.

- Corporate Governance GuidelinesPDF/305kB (November 29, 2024)

- Corporate Governance Report (Japanese version only)PDF/397kB (November 29, 2024)

- Action to Implement Management That Is Conscious of Cost of Capital and Stock PricePDF/322kB (March 15, 2024)

Management System

SUBARU has chosen a structure with a board of corporate auditors. The Board of Directors (eight members, of which three are independent outside directors) and the Board of Corporate Auditors (four members, of which two are independent outside auditors) decide, supervise, and audit the execution of important business.

This structure also enables us to achieve more sound and efficient business operations through increased effectiveness of management monitoring by involving highly independent outside directors and outside corporate auditors. At SUBARU, in order to enhance the practical governance structure based on our present organizational design, we have established two voluntary meetings: the Executive Nomination Meeting (consisting of five directors, of which three are independent outside directors) and the Executive Compensation Meeting (also consisting of five directors, of which three are independent outside directors).

As of the resolution of the 93rd Ordinary General Meeting of Shareholders held on June 19, 2024, SUBARU's corporate governance structure and the composition of the Board of Directors, Board of Corporate Auditors, Executive Nomination Meeting, and Executive Compensation Meeting are as follows.

Corporate Governance Structure

Composition of FYE March 2025 Board of Directors, Board of Corporate Auditors, Executive Nomination Committee, and Executive Compensation Committee

| Position | Name | Board of Directors | Board of Corporate Auditors | Executive Nomination Meeting | Executive Compensation Meeting |

|---|---|---|---|---|---|

| Representative Director | Atsushi Osaki | 〇 | 〇 | 〇 | |

| Representative Director | Fumiaki Hayata | 〇 | |||

| Directors | Tomomi Nakamura | ◎ | ◎ | ◎ | |

| Directors | Katsuyuki Mizuma | 〇 | |||

| Directors | Tetsuo Fujinuki | 〇 | |||

| Independent Outside Director | Miwako Doi | 〇 | 〇 | 〇 | |

| Independent Outside Director | Fuminao Hachiuma | 〇 | 〇 | 〇 | |

| Independent Outside Director | Shigeru Yamashita | 〇 | 〇 | 〇 | |

| Standing Corporate Auditor | Yoichi Kato | 〇 | ◎ | ||

| Standing Corporate Auditor | Hiromi Tsutsumi | 〇 | 〇 | ||

| Independent Outside Auditor | Yuri Furusawa | 〇 | 〇 | ||

| Independent Outside Auditor | Yasumasa Masuda | 〇 | 〇 |

◎ and 〇 indicate attendance of the chairman and other members, respectively.

Business Operation System

SUBARU has adopted an executive officer system and delegates directors' business execution authority to executive officers. By doing this, SUBARU clearly separates the function of decision making and the oversight of corporate management from that of the execution of business operations, expediting decision making.

Major Items Deliberated in FYE March 2024

The main activities of the Board of Directors, the Executive Nomination Committee, and the Executive Compensation Committee are as follows.

Board of Directors

Board of Directors

Meetings of the Board of Directors are held in principle once a month, and as needed otherwise, deliberating important matters based on the rules of the Board of Directors.

In FYE March 2024, the Board of Directors consisted of eight directors, including three independent outside directors, and met 13 times, chaired by Director and Chairman Tomomi Nakamura. The board's business during the fiscal year included overall oversight of Company management and determinations on important business execution.

In addition to the number of Board of Directors meetings held in the above table, one resolution was adopted in writing that was deemed to be a resolution of the Board of Directors in accordance with Article 370 of the Companies Act and the Articles of Incorporation.

Major Themes

- Determination of candidates for directors and corporate auditors, as well as the CEO and other members of the management team

- Matters pertaining to repurchase and cancellation of own shares

- Determination to revise the executive compensation system and the policy for determining the content of compensation, etc. for each individual director, and to delegate to the Executive Compensation Meeting regarding the determination of compensation, etc. for each individual director and executive officers under the executive compensation system

- Discussions on reports related to medium- and long-term management issues, including the EV strategy, IR/SR activities, the Sustainability Committee, and the Risk Management and Compliance Committee

Executive Nomination Meeting

The meeting is composed of three independent outside directors (Mr. Yasuyuki Abe, Ms. Miwako Doi and Mr. Fuminao Hachiuma) and two internal directors (Mr. Tomomi Nakamura and Mr. Atsushi Osaki). In order to ensure fairness and transparency of decisions on executive appointment, this voluntary committee, on request for consultation by the BoD, approves and submits the proposals to the BoD for the nomination of candidates for directors and corporate auditors and the selection and dismissal of executive officers, including the Chief Executive Officer (CEO), after ample deliberation.

The Executive Nomination Meeting was held eight times in FYE March 2024, chaired by Director and Chairman Tomomi Nakamura.

Major Themes

- Creating a succession plan for the CEO and others, 360-degree evaluation of executives, development of executive human resources with a focus on the CEO using the skills matrix for executives, revision of the skills matrix for executives (addition of ’reasons for skill selection” and ’definition of skill possession,” acceleration of the process for determining the executive structure, the Company's executive structure)

- Deliberations, etc., on personnel matters and the division of duties, as well as on the reporting of executive appointments for major subsidiaries

Executive Compensation Meeting

The meeting is composed of three independent outside directors (Mr. Yasuyuki Abe, Ms. Miwako Doi and Mr. Fuminao Hachiuma) and two internal directors (Mr. Tomomi Nakamura and Mr. Atsushi Osaki).

In order to ensure objectivity and transparency of decisions on executive compensation, this voluntary committee, on the basis of delegation by the BoD, determines individual compensation amounts per director and other issues after ample deliberation.

With regard to revisions of the compensation system and other matters pertaining to compensation overall, proposals approved by the Executive Compensation Meeting are deliberated and decided on by the BoD.

The Executive Compensation Meeting was held eight times in FYE March 2024, chaired by Director and Chairman Tomomi Nakamura.

Major Themes

- Reporting on proposed revisions to the director compensation system and the policy for determining the details of remuneration, etc., for individual directors

- Consideration of executive compensation levels using external survey data

- Determination of individual performance-linked compensation amounts for directors (excluding outside directors) and executive officers based on their evaluations

- Determination of individual base amounts, etc. for restricted stock compensation

Membership, Meetings Held, and Attendance for the Board of Directors, Executive Nomination Meeting, and Executive Compensation Meeting for FYE March 2024

| Position | Name | Board of Directors | Board of Corporate Auditors | Executive Nomination Meeting | Executive Compensation Meeting |

|---|---|---|---|---|---|

| Representative Director | Atsushi Osaki | 〇 100% (13 of 13 meetings) |

〇 100% (5 of 5 meetings)*2 |

〇 100% (6 of 6 meetings)*2 |

|

| Representative Director | Fumiaki Hayata | 〇 100% (13 of 13 meetings) |

|||

| Directors | Tomomi Nakamura | ◎ 100% (13 of 13 meetings) |

◎ (8 of 8 meetings) |

◎ (8 of 8 meetings) |

|

| Directors | Katsuyuki Mizuma | 〇 100% (13 of 13 meetings) |

|||

| Directors | Tetsuo Fujinuki | 〇 100% (10 of 10 meetings) |

|||

| Independent Outside Directors | Yasuyuki Abe | 〇 100% (13 of 13 meetings) |

〇 (8 of 8 meetings) |

〇 (8 of 8 meetings) |

|

| Independent Outside Directors | Miwako Doi | 〇 100% (13 of 13 meetings) |

〇 (8 of 8 meetings) |

〇 (8 of 8 meetings) |

|

| Independent Outside Directors | Fuminao Hachiuma | 〇 100% (10 of 10 meetings)*1 |

〇 (5 of 5 meetings)*2 |

〇 (6 of 6 meetings)*2 |

|

| Standing Corporate Auditor | Yoichi Kato | 〇 100% (13 of 13 meetings) |

◎ | ||

| Standing Corporate Auditor | Hiromi Tsutsumi | 〇 100% (13 of 13 meetings) |

〇 | ||

| Independent Outside Auditor | Yuri Furusawa | 〇 100% (13 of 13 meetings) |

〇 | ||

| Independent Outside Auditor | Yasumasa Masuda | 〇 100% (10 of 10 meetings)*1 |

〇 |

◎ and 〇 indicate attendance of the chairman and other members, respectively.

- *1

- Tetsuo Fujinuki, Director, Fuminao Hachiuma, Independent Outside Director, and Yasumasa Masuda, Independent Outside Auditor, were elected and appointed at the 92nd Ordinary General Meeting of Shareholders held on June 21, 2023.

- *2

- Atsushi Osaki, Director, and Fuminao Hachiuma, Independent Outside Director, were appointed as members of the Executive Nomination Committee and the Executive Compensation Committee by resolution of the Board of Directors held on June 21, 2023. This applies to subsequent meetings of the Executive Nomination Committee and the Executive Compensation Committee.

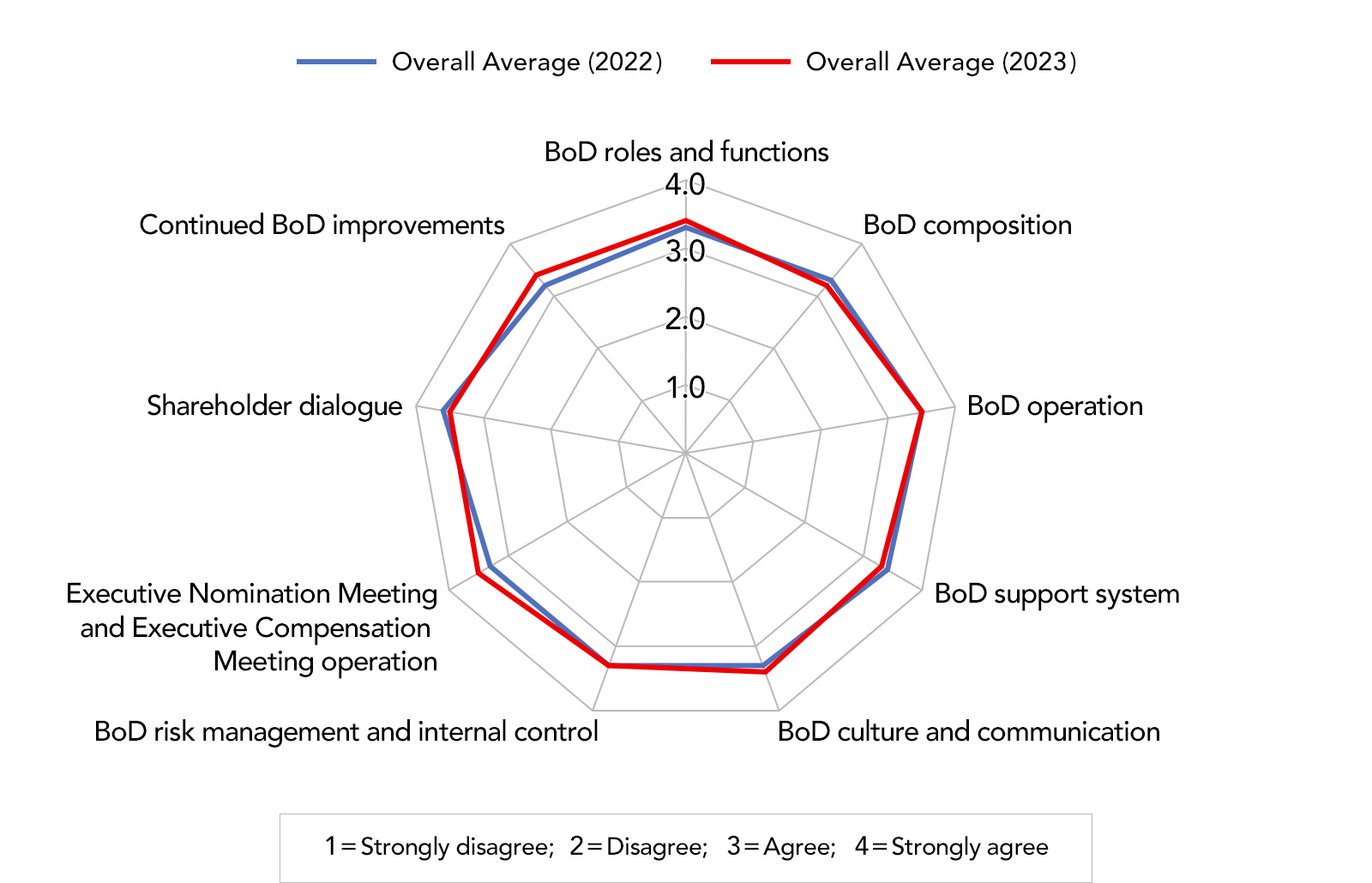

Effectiveness of the Board of Directors: Evaluation Results

In accordance with Article 23 of the Guidelines, the Board of Directors (’BoD”), on an annual basis, analyzes and evaluates the effectiveness of the Board, considers and implements measures to improve any issues identified, and then discloses an overview of the results in a timely, appropriate manner.

In the fiscal year ended March 31, 2024, aiming to apply the results of the evaluations toward enhancing the BoD's functions, the BoD confirmed efforts to address issues recognized in previous evaluations, reorganized the evaluation items on the survey and expanded the scope of interviews with directors, and assessed and analyzed the reasons and underlying factors behind differences in the recognition of issues.

Methods of evaluation and analysis

- (1)

- Timing: December 2023 – February 2024

- (2)

- Methods: Self-evaluation survey created by a third-party body;interviews

(a) Survey respondents: Directors (8) and auditors (4) for a total of 12 respondents

(b) Interviewees: Chair of the BoD, Representative Director and President, Representative Director and Executive Vice President, and outside directors (3) for a total of 6 interviewees

- (3)

- Process

(a) Third-party body conducts anonymous self-evaluation survey of directors and auditors

(b) Third-party body conducts interviews with the chair of the BoD, Representative Director and President, and outside directors

(c) Third-party body aggregates and analyzes survey responses and interviews

(d) BoD verifies and discusses reports received from third-party body

- (4)

- Evaluation items on the survey

- (a) BoD roles and functions

- (b) BoD composition

- (c) BoD operation

- (d) BoD support system

- (e) BoD culture and communication

- (f) BoD risk management and internal control

- (g) Executive Nomination Meeting and Executive Compensation Meeting operation

- (h) Shareholder dialogue

- (i) Continued BoD improvements

Respondents evaluated themselves on a four-point scale in response to questions relating to the evaluation items. They were also free to add their own thoughts on the characteristics of the BoD and points that they felt would be necessary in enhancing the effectiveness thereof. Upon completing their responses, they then submitted their surveys directly to the third-party body.

Evaluation results

Based on the third-party body's report detailing its aggregation and analysis, the BoD discussed and confirmed the following points.

- (1)

- General evaluation

The evaluation determined that the Subaru Corporation BoD is effective in providing strong executional support to actively propel strategies under the new management structure.

- (2)

- Characteristics of the Subaru Corporation BoD

The following four points were listed as characteristics of the Subaru Corporation BoD.(a) A BoD with a focus on the monitoring function

BoD discussions take place on the premise that the Company occupies a unique position within the industry, a point that outside directors also understand. The BoD currently functions effectively, providing a supportive foundation for clear strategic direction-setting, enthusiastic business execution, and monitoring of execution.(b) An environment conducive to free and open discussion

The environment within the BoD makes it easy for members to voice their ideas and opinions, thereby enabling free and open discussion.(c) A strong awareness of compliance and risk management

The BoD demonstrates a strong awareness of compliance and risk management in many ways, including five reports from the Risk Management and Compliance Committee each year.(d) A secretariat that functions as an effective support structure

Outside directors noted almost no concerns or complaints about the provision of information, prior explanations, materials for BoD meetings, or other items. The secretariat functions effectively as a hub for supervision and execution.

- (3)

- Status of responses to points to examine from last fiscal year's evaluation

The status of responses to the following three points, listed in last year's evaluation as requiring examination to further enhance the effectiveness of the Subaru Corporation BoD, is as follows.(a) Discussing medium- to long-term management strategy (improvements made)

The BoD has flexibly utilized social gatherings of management personnel* and engaged in fruitful discussions. The BoD will continue to update information on the status of progress on medium- to long-term management strategy and other topics on a regular basis.(b) Further bolstering the support system for outside directors (improvements made)

By creating more opportunities for outside directors to obtain information, including information-sharing outside BoD meetings and visits to factories and other sites, the BoD has bolstered its framework for helping outside directors perform their functions effectively.(c) Further improving the effectiveness of the Executive Nomination Meeting (improvements still in progress)

Given the recent change in CEO, discussions will need to address enhancement of the succession process for the CEO position. One important point for the Executive Nomination Meeting to consider will be its involvement in the succession processes for executive officers, including the formulation of development schemes and systematic development through the effective use of skill matrices.* Events held by directors and corporate auditors where opinions are exchanged on topics that are important for Subaru Corporation management, but do not require resolution

- (4)

- Future points to examine for further enhancing the effectiveness of the BoD

The following three points were listed as requiring examination to further enhance the effectiveness of the BoD.(a) Establishing common ground on key agenda items for medium- to long-term management strategy and on approaches to monitoring

The BoD will continue to energize its discussions on agenda-setting and Group-wide monitoring in line with progress on electrification and other components of the New Management Policy.(b) Further bolstering the support system for outside directors

To help outside directors perform their functions more effectively, the BoD will provide more opportunities to communicate with top executives and auditors.(c) Further strengthening the functions of the Executive Nomination Meeting

The BoD will take steps to further enhance processes for developing and selecting candidates for CEO and other positions, such as revising the process for appointing outside directors, organizing and utilizing skill matrices for all executive officers, and enhancing discussions on succession.

Survey results

| Evaluation Item | |

|---|---|

| (a) BoD roles and functions | Recognition of the roles and functions of the Board of Directors |

| Delegation of authority to execution | |

| Reporting system | |

| Supervision of corporate management | |

| (b) BoD composition | Size of the Board of Directors |

| Composition of the Board of Directors (ratio of inside to outside directors) | |

| Composition of the Board of Directors (diversity and expertise) | |

| (c) BoD operation | Frequency, length, and time allocation of meetings |

| Relevance of agenda items | |

| Timing of proposals and discussions | |

| Quality and quantity of documents | |

| Timing of document distribution | |

| Prior explanation | |

| Content of explanations and reports | |

| Discussions by the Board of Directors | |

| Leadership by the Chair | |

| (d) BoD support system | Environment and systems for the provision of information |

| Provision of information to outside officers | |

| Training of outside officers | |

| Training of inside officers | |

| (e) BoD culture and communication | Diverse values |

| Stakeholder perspectives | |

| Directors and business divisions | |

| Inside and outside directors | |

| Directors and corporate auditors | |

| (f) BoD risk management and internal control | Risk management |

| Group governance | |

| Internal control and compliance | |

| (g) Executive Nomination Meeting and Executive Compensation Meeting operation | |

| (h) Shareholder dialogue | Supervision of proper disclosure of information to shareholders and investors |

| Sharing the views of shareholders and investors | |

| Enhancing dialogue with shareholders and investors | |

| (i) Continued BoD improvements | Status of improvements based on the previous fiscal year's effectiveness evaluation |

Approach to the CEO Succession Plan

SUBARU recognizes that decision making regarding top management changes and successor selection may have a critical influence on corporate value. Therefore, in order to ensure a successful succession at the right timing, we invest substantial time and resources to carefully develop and implement succession plans.

In order to hand over the business to the right person, the BoD, as part of its essential duties, develops succession plans that can convince all stakeholder groups. To ensure objectivity and transparency in the process for deciding on the replacement and selection of the CEO, the BoD appropriately supervises the preparation of proposals by the current CEO through discussions at the Executive Nomination Meeting.

To be able to implement succession plans appropriately, the CEO begins to prepare for selection and development of their successor candidates independently upon assuming office. Key processes for this purpose include providing information on candidates to outside directors on an ongoing basis, particularly by enabling the directors to monitor the candidates in person continuously in day-to-day business settings, as a measure to ensure appropriate and timely evaluation and selection down the road.

The BoD and Executive Nomination Meeting meet on a regular basis to review the list of essential qualities and skills required of the CEO, which may include removing and adding items, in consideration of perception of current trends, changes in the business environment surrounding the Company, and the future direction of the Group's business strategies.

To ensure the objectivity of the successor selection process and increase the effectiveness of its supervision by the Board of Directors and Executive Nomination Meeting, it is important to have effective selection criteria in place, particularly for use by outside directors. To this end, SUBARU discloses two sets of criteria: ’Abilities required of the SUBARU Group's CEO” and ’Five key qualities required of the SUBARU Group's CEO.” These criteria serve as a guide for evaluating candidates in light of quality, competency, experience, track record, specialized expertise, personality, and other factors, which have been discussed and decided on by the Board of Directors and Executive Nomination Meeting.

Abilities required of the SUBARU Group's CEO

The SUBARU Group's CEO must be able to: properly understand the business environment surrounding SUBARU, its corporate culture and philosophy, business growth stages, and medium- to long-term management strategies and challenges; facilitate collaboration appropriately with various stakeholders; and lead all executives and employees to work together to maximize corporate value.

Five key qualities required of the SUBARU Group's CEO

1. Integrity

2. Broad perspective

3. Character

4. Tireless spirit or revolutionary leadership skills

5. Person of action

Executive Officer Training

| Category | Training Policy / Major Ongoing Programs | |

|---|---|---|

| Directors Auditors |

Policy | SUBARU provides its directors and auditors with information and knowledge regarding its business activities that is necessary for them to fulfill their responsibilities to oversee and audit directors and auditors on an ongoing basis. |

| Training |

|

|

| Outside directors Outside auditors |

Policy | SUBARU provides its outside officers on an ongoing basis with information relating to the Company's corporate statement, corporate culture, business environment, and other matters, mainly through arranging appropriate opportunities, such as operations briefings from business divisions and factory tours, as well as creating an environment for officers to share information and exchange opinions more easily. |

| Training |

|

|

| Executive officers | Policy | SUBARU gives executive officers similar opportunities as those given to directors and corporate auditors, for the purpose of developing human resources to lead its management in the future. |

| Training |

|

|

Note: Expenses to be incurred for offering the above training to directors and auditors, including outside officers and executive officers are borne by the Company.

| Category | Programs provided in FYE March 2024 |

|---|---|

| All executives |

|

|

|

| Outside directors Outside auditors |

|

|

|

|

Outside Directors, and Outside Auditors

Nomination Criteria

- The outside directors are expected to perform a monitoring function independent from the management team and provide appropriate advice on management on the basis of a wide range of sophisticated knowledge.

- The outside corporate auditors are expected to perform a management oversight function independent from the management team and undertake their role of auditing from the viewpoint of legality and appropriateness on the basis of broad and advanced knowledge.

- SUBARU has established criteria for independence of outside officers in addition to the criteria for independence established by the Tokyo Stock Exchange, and appoints outside directors and outside corporate auditors who meet those criteria.

| Name | Reasons for Appointing | Significant concurrent positions* |

|---|---|---|

| Miwako Doi Appointed June 2020 |

As a researcher and supervisor in the field of information technology at Toshiba Corporation, Ms. Miwako Doi has accumulated vast experience and made many achievements in this field over many years. In addition, she has held successive positions, mainly in government committees, owing to her high level of expertise and extensive experience and knowledge. In June 2020, the Company appointed her to the position of independent outside director. Given that she has been providing beneficial advice to the Company's management for the generation of new innovation, we appointed Ms. Doi with the expectation that she will provide sufficient advice and oversight of all aspects of the Company's management from an independent perspective as an outside director of the Company and that she will continue to appropriately perform her duties as an independent outside director of the Company. |

Auditor, National Institute of Information and Communications Technology (NICT) (part-time) Executive Vice President, Tohoku University (part-time) Executive Director, Nara Institute of Science and Technology (part-time) Outside Director, NGK Spark Plug Co., Ltd. |

| Fuminao Hachiuma Appointed June 2023 |

Mr. Fuminao Hachiuma has abundant experience and knowledge acquired through his involvement in management in a broad range of fields including overseas business at Ajinomoto Co., Inc. and its group companies as well as promotion of strengthening of corporate governance and management reform of J-OIL MILLS, INC. as Representative Director and President. In June 2023, the Company appointed him to the position of independent outside director. Given that Given that he has been providing frank opinions on the Company's management, we appointed Mr. Hachiuma with the expectation that he will provide sufficient advice and oversight of all aspects of the Company's management from an independent perspective as an independent outside director of the Company and that he will continue to appropriately perform his duties as an independent outside director of the Company. |

Outside Director, Seven & i Holdings Co., Ltd. Outside Audit & Supervisory Board Member, YKK AP Inc. |

| (Newly appointed) Shigeru Yamashita Appointed June 2024 |

Since his appointment as Representative Director of Pigeon Corporation, Mr. Shigeru Yamashita has led that company's efforts to promote management transformation, strengthen corporate governance, and maximize corporate value, and has abundant experience and insight in business management. In light of this, the Company has appointed Mr. Yamashita as a new independent outside director in the expectation that he will provide sufficient advice and oversight of all aspects of the Company's management from an independent perspective as an independent outside director of the Company, and that he will appropriately perform the duties of independent outside director of the Company. |

|

| Yuri Furusawa Appointed June 2022 |

Ms. Yuri Furusawa has held key positions in the Ministry of Land, Infrastructure, Transport and Tourism, and has been involved in the promotion of work style reform, active participation by women and diversity in the Cabinet Secretariat, as well as in the overseas business development in the private sector, giving her a broad perspective and a high level of insight. In light of this, the Company has appointed Ms. Furusawa with the expectation that she will appropriately perform her duties as an independent outside auditor of the Company. | Outside Audit & Supervisory Board Member, Kubota Corporation |

| Yasumasa Masuda Appointed June 2023 |

Mr. Yasumasa Masuda has served as CFO at Astellas Pharma Inc. and has deep insight in overall management with focus on financial and accounting. He has also served as Independent Non-Executive at Deloitte Tohmatsu LLC and Outside Director and Chairman of the Audit Committee at Olympus Corporation, giving him a broad perspective and a high level of insight. In light of this, the Company has appointed Mr. Masuda with the expectation that he will appropriately perform his duties as an independent outside auditor of the Company. |

- *

- The status of “Significant Current Positions” is as of September 30, 2024.

Compensation for Directors

Matters Concerning the Policy for Determining Details of Compensation for Individual Directors

SUBARU deliberated and decided on the proposal of the Policy for Determining Details of Compensation for Individual Directors approved by the Executive Compensation Meeting at the Board of Directors' meeting held on March 3, 2022. To the right is the summary of the policy.

Policy for Determining Details of Compensation for Individual Directors

1. Basic policy

As a basic policy, compensation for directors of the Company is determined in view of the following items:

(1) Compensation is at a level commensurate with the roles and responsibilities of directors and is appropriate, fair, and balanced.

(2) The compensation structure is determined by giving consideration to providing motivation for sustained improvement in corporate performance and corporate value and securing excellent human resources.

Specifically, for directors (excluding outside directors), compensation is composed of basic compensation, annual performance-linked bonus, and restricted stock compensation (for non-resident officers, phantom stock instead of restricted stock). For outside directors, the Company pays only basic compensation in view of their roles of fulfilling monitoring and oversight functions of corporate management from an independent position. The total amount of compensation for individual directors and the levels of each compensation item are set for every position depending on difference in responsibility by utilizing the research data compiled by outside specialized agencies.

2. Policy for determining the amount of monetary compensation excluding performance-linked compensation (hereinafter, the ’Fixed Monetary Compensation”), performance-linked compensation, and non-monetary compensation (including the policy for determining the timing or conditions for granting such compensation)

(1) Policy for the Fixed Monetary Compensation

Directors receive the Fixed Monetary Compensation monthly as basic compensation. The amount for individual directors is determined based on their positions, taking into consideration elements such as the business environment.

(2) Policy for performance-linked compensation

For annual performance-linked bonus for directors (excluding outside directors), we have set a compensation table based on rank and the KPI of consolidated profit before tax for the fiscal year under review. Based on this table, cash compensation is paid at a certain time of each year. In addition, in order to encourage the achievement of goals in the Group's medium- to long-term strategy, a portion of restricted stock compensation (described in (3) below) to be granted as non-monetary compensation will be PSUs, where the number of shares granted is linked to the degree to performance target achievement. In addition to consolidated ROE, which is the financial indicator emphasized in our medium-term strategy, we will adopt employee engagement as a non-financial KPI for these PSUs.

The Company will review the KPIs for annual performance-linked bonus and PSUs as needed based on changes in the environment and reports from the Executive Compensation Meeting.

(3) Policy for non-monetary compensation

The Company grants restricted stock compensation to directors (excluding outside directors) for the purpose of providing them an incentive for sustained improvement of the Company's corporate value and further value sharing with the shareholders. For restricted stock compensation, a portion shall be provided as the fixed compensation type, with the rest as the variable compensation type. Both of these shall be prohibited from being transferred during the recipient's term of office, and this restriction on transfer shall be lifted upon their retirement.

For fixed compensation type restricted stock (RS) compensation, shares of the Company's common stock are granted at a certain time each year at an amount equivalent to a base amount determined in consideration of the Company's business performance, responsibilities of each director, and other factors.

For variable compensation type restricted stock compensation (PSUs), units (one unit = one share) are granted at a certain time each year at an amount equivalent to a base amount determined in consideration of the Company's business performance, responsibilities of each director, and other factors. After an evaluation period, shares of the Company's common stock are granted at an amount equivalent to the number of units multiplied by a payout ratio (50% to 100%) determined in accordance with achievement levels for performance indicator targets.

The maximum number of shares of the Company's common stock to be granted as restricted stock compensation to directors, for RS and PSUs combined, is 150,000 per year. In addition, the Company and its directors shall enter into a restricted stock allotment agreement that includes an overview and provisions that state (1) Company executives shall not, while they serve in their positions as executives and for a set period of time, transfer, create a security interest on, or otherwise dispose of the shares of the Company's common stock that have been allotted to them, and (2) the Company may acquire the said shares of its common stock without compensation if certain events occur. If a director is a non-resident of Japan at the time shares are granted, the Company shall grant phantom stock in place of and equivalent to the restricted stock compensation that would have been granted, and the stock shall also be treated in accordance with the restricted stock allotment agreement.

3. Policy for determining the proportion of the Fixed Monetary Compensation, performance-linked compensation, and non-monetary compensation to the total amount of compensation, etc., for individual directors

The Company has set the following as a general guideline for proportions of compensation by type for directors (excluding outside directors) in reference to the compensation levels and compensation mix of companies of a similar scale to the Company or industry peers obtained through an external research company, and in consideration of factors such as the Company's overall salary level and social situations (performance-based compensation is a proportion of the base amount).

| Breakdown | Rate | |||||

|---|---|---|---|---|---|---|

| Basic compensation | Annual performance-linked Compensation | Restricted stock compensation | President | Directors other than the President | ||

| RS | PSU | |||||

| Fixed monetary compensation | ● | 45% | 50% | |||

| Performance-linked compensation | ● | ● | 45% | 40% | ||

| Non-monetary compensation | ● | ● | 25% | 20% | ||

The Company shall appropriately review the compensation level and compensation mix in consideration of the Company's business environment, as well as the situation of companies of a similar scale to the Company or industry peers, and other circumstances based on reports from the Executive Compensation Meeting.

4. Matters concerning the determination of details of compensation, etc., for individual directors

The Executive Compensation Meeting, by a resolution of and upon delegation by the Board of Directors, determines specific amounts of compensation, etc., of individual directors, following sufficient deliberation by its members including outside directors. Its authorities include the determination of specific amounts of basic compensation, annual performance-linked bonus, and restricted stock compensation (includes phantom stock), and their payment schedule. With regard to revisions of the compensation system and other matters pertaining to compensation overall, proposals approved by the Executive Compensation Meeting are deliberated and decided on by the Board of Directors. The total amount of compensation for individual directors and the levels of each compensation item are set depending on their responsibilities, and whether he or she is an internal or outside director, by utilizing research data compiled by outside specialized agencies.

To ensure transparency and effectiveness of the executive compensation determination process, the Executive Compensation Meeting shall, by a resolution of the Board of Directors, be structured so that the majority of its members are outside directors, and its chairman shall be appointed by a resolution of the Board of Directors.

Overview of executive compensation system

Composition of compensation

The ratio of compensation for the Representative Director, President and CEO will be set as 45% for basic compensation, 30% for annual performance-linked compensation, and 25% for restricted stock compensation (15% for variable compensation type (PSU) + 10% for fixed compensation type (RS*)) upon achievement of the KPIs set forth in the STEP mid-term management vision.

As before, outside directors will only receive basic compensation.

*Restricted stock

Compensation System for Directors (excluding outside directors)

Total Compensation for Directors and Auditors for FYE March 2024

(Millions of yen)

| Classification | Basic compensation (Paid in fixed monthly installments) |

Short-term Performance-linked Compensation | Restricted Stock Compensation | Total |

||

|---|---|---|---|---|---|---|

| PSU | RS | |||||

| Directors: 11 | Internal directors: 7 | 213 | 244 | 69 | 65 | 591 |

| Outside directors: 4 | 38 | – | – | – | 38 | |

| Auditors: 6 | Internal corporate auditors: 2 | 63 | – | – | – | 63 |

| Outside auditors: 4 | 26 | – | – | – | 26 | |

| Total: 17 | 340 | 244 | 69 | 65 | 718 | |

- *1

- Figures in the above table include two internal directors, one outside director, and two outside corporate auditors who resigned before the last day of FYE March 2024. At the end of FYE March 2024, there were eight directors, including three outside directors, and four corporate auditors, including two outside corporate auditors.

- *2

- Total amounts in the above table represent the amounts recorded as expenses at the end of FYE March 2024 and include contingent compensation (such as phantom stock and PSUs granted to non-residents in Japan).

- *3

- The amounts for phantom stock and PSUs are calculated based on the closing price of the Company's common stock on the Tokyo Stock Exchange Prime Market as of March 31, 2024, and the stock price at the time of grant will be applied for the actual payment.

Revision of Executive Compensation System

To provide more incentive for Company directors and executive officers (excluding outside directors) for achieving sustained improvement of the SUBARU Group's value over the medium and long term, we revised our restricted stock compensation plan in FYE March 2025 as part of our review of the executive compensation system. The revisions primarily focus on the following three points, which were approved at the 93rd Ordinary General Meeting of Shareholders held on June 19, 2024, and have been applied to the executive compensation for FYE March 2025.

Greater Ratio of Stock Compensation

In FYE March 2018, we introduced fixed compensation type restricted stock compensation (RS) for directors and executive officers. In FYE March 2023, we added variable compensation type performance share units (PSU), gradually increasing the weight of stock compensation. In the FYE March 2025 revision, we further increased the proportion of stock compensation to strengthen the link between compensation and the enhancement of corporate value. As a result of this revision, the composition ratio of basic compensation, annual performance-linked bonuses, and restricted stock compensation for the Representative Director, President and CEO has been set at 1:0.5:0.7 (for the latter, 0.5 for PSUs plus 0.2 for RS). As before, outside directors will only receive basic compensation.

Addition of Relative TSR (vs. TOPIX Growth Rate Including Dividends) as a KPI for PSUs

In the FYE March 2025 revision, we added relative TSR (compared to the TOPIX growth rate including dividends) as a new KPI in the quantitative (financial) evaluation, in addition to the previous KPIs. This indicator is aimed at enhancing corporate value.

Introduction of a Clawback Clause for Stock Compensation

To improve compensation governance, a clawback clause has been introduced into the stock compensation system alongside the increase in the proportion of stock compensation. If, during the restricted transfer period or within three years after the termination of the restrictions on transfer, it is found that an executive has committed an act of misconduct or that there is a material error in the performance on which the grant of stock was premised, the Company may, based on the details discussed and decided by the Executive Compensation Meeting and by a resolution of the Board of Directors, acquire the executive in question's allotted shares in whole or in part without compensation, or demand that the executive pay an amount equivalent to the market value of the shares in question.

Preventing Conflicts of Interest

The approval of the Board of Directors is obtained in advance where a transaction poses the risk of a conflict of interest. A report on the positions that each director has held concurrently over the past financial year is provided once a year at the April meeting of the Board of Directors (a report to confirm that there have been no improper transactions or positions held).

Auditing by Corporate Auditors

The Board of Corporate Auditors, as an independent organization entrusted by shareholders, is responsible for ensuring the sound and sustainable growth of SUBARU and establishing a high-quality corporate governance system that can be trusted by society by performing audits of the execution of duties by directors, passing resolutions on the contents of proposal items regarding the appointment and dismissal, or non-reappointment, of accounting auditors that are to be submitted to the General Meeting of Shareholders, and performing business audits, accounting audits, and other matters prescribed by laws and regulations.

The number of Board of Corporate Auditors members is stipulated to be up to five in the Articles of Incorporation, and as of the conclusion of the 92nd Annual General Meeting of Shareholders held on June 21, 2023, the board consists of four members (including two independent outside auditors). The chairman is a standing corporate auditor, and the board held 12 meetings in the fiscal year 2023.

Auditing

Auditing by Corporate Auditors

In addition to attending important meetings such as the Board of Directors, the Company’s corporate auditors engage in activities that include exchanging opinions with executive officers and communicating individually with the directors and corporate auditors of Group companies. Through these efforts, they gather extensive information on business execution, including the development and operational status of internal controls across the Group, as well as verify their effectiveness. Additionally, necessary advice and recommendations are provided based on the observations obtained from these audit activities.

Activities in FYE March 2024

Major Activities of the Corporate Auditors

• Confirming management monitoring and execution

Each corporate auditor attended important meetings, including those of the Board of Directors, Executive Management Board Meeting, and Risk Management and Compliance Committee. When in attendance, they monitored management decision-making processes, sought explanations as necessary (including through opportunities other than those meetings), and actively expressed their opinions.

• Communication with directors, executive officers, and others, and confirmation of internal control status at various business establishments, including Group companies

Through exchanges of opinions with directors, executive officers, and others, as well as visits to and inspections of major business establishments and Group companies, and collaboration with the directors and corporate auditors of Group companies, the corporate auditors confirmed the status of business execution, including the development and operation of the Group’s internal controls.

Through regular meetings with the Legal Department, Risk Management and Compliance Office, and Internal Audit Department, they confirmed the status of risk management practices across the Group.

• Cooperation in the three-party audit system

Corporate auditors conducted regular reporting sessions with the Internal Audit Department and accounting auditors, facilitating information sharing and exchanges of opinions that fostered close cooperation in the three-party audit system. By implementing coordinated audit activities, they carried out mutual verification of the effectiveness of internal controls across the Group.

Board of Corporate Auditors Number of Meetings Held: 12

• Matters for resolution

Audit policy, audit plan and division of audit duties, consent to agenda items for the General Meeting of Shareholders (appointment of corporate auditors), evaluation and selection/dismissal of the accounting auditors, consent to the audit fee for the accounting auditors, preparation of the audit report, etc., for the current fiscal year.

• Matters for reporting

The Board of Corporate Auditors shared reports and insights based on findings obtained from individual corporate auditor activities. Additionally, the Board received reports from the responsible departments on risk management issues from a preventive audit perspective, enabling them to verify the appropriateness of management execution.

Internal Auditing

The Internal Audit Department evaluates the development and operational status of internal controls and the effectiveness of risk management from an independent and objective standpoint, while verifying the appropriateness of business execution at SUBARU and its Group companies in Japan and overseas, providing advice and proposals for improvement as required.

System and Initiatives

The Internal Audit Department, comprising 18 members, reports directly to the President. This department formulates a business audit plan at the beginning of each fiscal year, taking into consideration the risks and internal control status of the entire Group, and conducts operational audits accordingly.

Reporting of Business Audit Results

Audit reports on business execution are distributed to all directors, corporate auditors, and relevant departments, and simultaneously presented to the President at a monthly reporting meeting. Reports are also provided to the Board of Directors semiannually and to a joint meeting composed of all executive officers on a quarterly basis.

Internal Control

Management System

With the aim of increasing the effectiveness of internal controls and risk management, the Internal Audit Department was made independent of the Risk Management Group (overseen by the Chief Risk Management Officer (CRMO)) to ensure a higher level of independence of internal audit units in the organization and to enhance the effectiveness of internal controls.

Internal Control System

In accordance with the Companies Act and the Ordinance for Enforcement of the Companies Act, SUBARU's Board of Directors has adopted a basic policy on putting in place systems that ensure that the performance of duties by directors is in conformity with laws and regulations and with the Articles of Incorporation, and other systems prescribed in the ordinance of the Ministry of Justice as being necessary to ensure the appropriate operations of the Company and the corporate group consisting of the Company and its subsidiaries. The Board of Directors maintains and operates this basic policy, reviewing it as needed.

Internal Control System Related to Financial Reporting

Regarding internal control reporting systems pursuant to the Financial Instruments and Exchange Act, the evaluation of the internal control system related to financial reporting is dated the final day of the consolidated accounting period and is conducted in accordance with generally accepted assessment standards for internal control over financial reporting.

The President and Chief Executive Officer (CEO) and the Chief Financial Officer (CFO) evaluated the status of the development of the internal control system related to financial reporting as of March 31, 2024 and affirmed that it has been established properly and functions effectively, and issued an internal control report audited by the accounting auditors to that effect.

SUBARU Group Governance

The SUBARU Group has established a Group-wide governance stance that contributes to the sound business operations of the Group's global companies in order to maintain and enhance brand value and enhance the overall strength of the Group in response to social demands, including for sound corporate governance.

Group Companies (Affiliates in Japan, Excluding SUBARU Dealerships)

In the SUBARU Group, the Business Administration Department of SUBARU manages each Group company and their businesses to promote more unified activities. In addition, we have created a system in which SUBARU's corporate departments support these activities, thereby enhancing the effectiveness of Group governance.

1. Accelerating the group collaboration system

The efforts of the Group's collaboration system that started in FYE March 2022 have penetrated the Group, and communication between the Business Administration Department and Group companies has gradually deepened. SUBARU's corporate departments have established a new Group Review Meeting for collaborative discussion of major issues with each Group company to enhance the effectiveness of governance. By accelerating these efforts, we are working to further enhance the quality of Group governance.

■ Deepening communication with the Business Administration Department

We have introduced and implemented a new tool that allows Group companies and the Business Administration Department to review the goals and outcomes of the year's business activities and governance initiatives throughout the year. Through this, we are not only enhancing communication between both parties but also elevating the quality of governance.

■ Enhancing support for Group companies

Relevant corporate departments are working together to evaluate and implement concrete support measures for Group companies as appropriate. As an example, SUBARU is continuing to explore and implement corporate-related measures, including activities in which staff from SUBARU's finance and administration departments share information and provide support in financial and accounting domains to each company in addition to enhancing education programs for Group employees.

2. Initiatives to enhance the effectiveness of governance

As basic governance activities, we continue to promote the development of forums for information sharing and exchange of opinions with Group companies and the creation of educational opportunities. As part of this, we share information on governance-related themes at meetings of Group company presidents, respond quickly to various issues at the Management Department Steering Committee, and regularly discuss corporate issues at the Group Review Meeting, which was launched in FYE March 2024. In addition, we are also focusing on employee education as part of efforts to enhance the quality of Group human resources.

Through these efforts, we are working to further improve the effectiveness of Group governance.

Initiatives in the SUBARU Group

- Held meetings of Group company presidents (three meetings in June and November 2022, and March 2023)

- Held Management Department Steering Committee meetings (six meetings from April and then every other month, covering 26 topics)

- Held Group Review Meetings to foster collaborative discussions between SUBARU and its Group companies regarding key corporate challenges (two in FYE March 2024)

- Information sharing through a dedicated portal site for Group companies

- Held workshops for newly appointed executives (once in April)

- Staff from finance and administration departments share information and provide support to individual companies

- Extended SUBARU's educational framework to Group company employees

- Dispatched personnel from the Business Administration Department of SUBARU to play a part in the management of Group companies by serving as part-time directors

- Enhanced the quality of auditing through appropriate assignment of standing corporate auditors (14, March 31, 2023)

Dealerships

Enhancing governance at SUBARU dealerships involves the Japan Sales & Marketing Division assuming the responsibilities of the Business Administration Department. This enables close communication between SUBARU and its dealerships, advancing initiatives that contribute to the Group's sustainable growth and medium- to long-term enhancement of corporate value.

Initiatives for SUBARU dealerships

- Established the Risk Management and Compliance Committee

- Developed regulations and established and enhanced operation of an internal control system for audits, etc., conducted by the auditing departments of dealerships

- Held General Meeting of Shareholders and Board of Directors' meetings

- Enhanced the quality of auditing through appropriate assignment of full-time corporate auditors (introduced full-time corporate auditors at 10 companies)

Note: Parentheses indicate information as of April 2024.

Efforts to deepen communication between SUBARU and its dealerships

- Held monthly Leadership Meetings with 10 key dealerships we have invested in

- Held Specialist Committee meetings in four areas (sales, service, pre-owned vehicles, and IT) (at least once every six months)

- Meetings of the Internal Audit Department Liaison Committee (held twice a year)

- Implemented dealership audits through SUBARU's Audit Department

- Dispatched part-time directors from SUBARU to 10 dealerships

- Implemented training for newly appointed executives at SUBARU dealerships

- Established and enhanced operation of an internal control system for audits, etc. based on J-SOX, conducted by the auditing departments of dealerships

- Held General Meeting of Shareholders and Board of Directors' meetings

- Enhanced the quality of auditing through appropriate assignment of full-time corporate auditors (introduced full-time corporate auditors at 10 companies)

Note: Parentheses indicate information as of April 2024.

Cross-Shareholding

(1) Policy for cross-shareholding

SUBARU holds listed stocks as cross-shareholdings and engages in dialogues with the companies in question. Each year, SUBARU's Board of Directors quantitatively measures and compares benefits from holding, using dividend yield, and the capital cost involved, using weighted average cost of capital (WACC), in order to verify each. The Company will maintain these holdings only if it deems, based on the results of this verification, that the shares will contribute to its medium- to long-term management and business strategies in a qualitative manner.

(2) Verification details for cross-shareholding

Based on the above policy, SUBARU has steadily reduced the number of listed stocks held as cross-shareholding. As a result, 60 issues held at the end of March 2015 decreased to two issues at the end of March 2021. We consider these two issues to be essential to hold at this time for the following reasons, but we will continue to hold dialogue with these companies at least once a year, and the Board of Directors will evaluate and scrutinize these issues annually to determine whether they should be held or not.

As of March 31, 2024

| Issues | Number of shares | Amount reported on the balance sheet (Millions of yen) |

Purpose of holding, impact of holding, and reason for increase in number of shares |

|---|---|---|---|

| The Gunma Bank, Ltd. | 2,850,468 | 2,503 | The Gunma Bank, a local bank of the area where the Company's main factory resides, is supporting not only SUBARU but also local supplier sites in Japan and abroad through its financial services. As the is an important partner, the Company will continue to hold the bank's shares to promote fair and smooth financial transactions. |

| Mizuho Financial Group, Inc. | 372,097 | 1,133 | The Mizuho Financial Group firms have been supporting SUBARU with financial transactions and other services. In particular, the Mizuho Bank has long been the Company's most important financial partner, providing support in a broad area of management. The Company will continue to hold the group's shares to promote fair and smooth transactions. |

(3) Criteria for exercising voting rights for cross-shareholding

With regard to the exercise of voting rights for listed stocks held as cross-shareholding, the Board of Directors deliberates on and determines the criteria for exercise with evaluation items such as whether the company is consistently exhibiting poor performance, whether a sufficient number of independent outside directors are in place and if management is supervised appropriately, and whether there are any corporate governance issues present. Although these are our general principles, we hold dialogues at least once a year with companies whose stock we hold to avoid making blanket decisions. Accordingly, we exercise our voting rights appropriately in light of the performance, management policies, and medium- to long-term management plans of the companies in question, as well as from the perspectives of corporate value enhancement, corporate governance, and social responsibility.

In addition, we will continue to verify whether or not our criteria for exercise of voting rights warrant review.