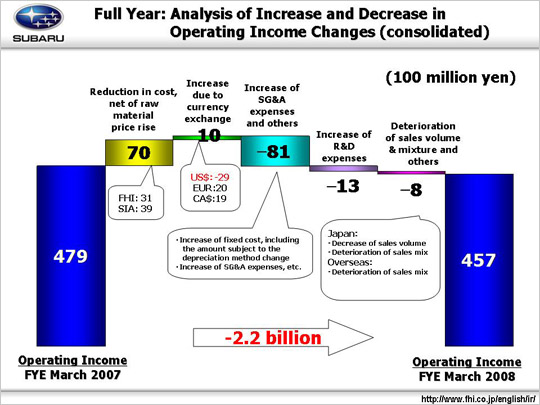

Next is our explanation of factors which increased and decreased operating income, which decreased from 47.9 billion yen to 45.7 billion yen.

Factors which increased operating income reduction in cost, net of raw material price raise, which amounted to 7.0 billion yen, consisting of 3.1 billion yen from FHI and 3.9 billion yen from SIA. The increase also includes impacts from soaring prices of steel plates, crude oil, and raw material for precious metals, amounting to 8.9 billion yen.

Gain on currency exchange amounted to 1.0 billion yen. Approx. one-yen appreciation against the US dollar caused an exchange loss of 2.9 billion yen. Approx. 11-yen depreciation against Euro added an exchange gain of 2.0 billion yen. Approx. 8-yen depreciation against the Canadian dollar added an exchange gain of 1.6 billion yen to FHI exports to Canada. Exchange gain amounted to 0.3 billion yen for SIA export to a Canadian subsidiary at the appreciated CA$/depreciated US$. Total CA$ exchange gains amounted to 1.9 billion yen.

Meanwhile, factors which decreased operating income include increase of SG&A expenses and others, amounting to 8.1 billion yen. These expenses are classified into the following four items. First, (1) -6.8 billion yen due to increased fixed cost (-9.7 billion yen from FHI and +2.9 billion yen from SIA). FHI had an increase in suppliers’ mold cost and an increase in fixed processing cost, while SIA had an increase in suppliers’ mold cost which were offset by a decrease in fixed processing cost, etc. (2) Increase in SG&A expenses resulted in -2.6 billion yen in operating income, (-2.4 billion yen in domestic operating income). FHI had an increase in advertisement expenses, as well as an increase in transportation and storage charges and an increase in sales service expense due to favorable sales performances overseas. Meanwhile, overseas operating income decreased 0.2 billion yen. Specifically, SOA cut sales promotion incentives by $200 per unit year on year, which compensated for increased advertising expenses, resulting in +2.4 billion yen in operating income. However, other subsidiaries had increased SG&A expenses. (3) Decrease in accrued warranty claims resulted in +2.4 billion yen in operating income. (4) Other items had the remaining minus (-1.1 billion yen).

Increased R&D expenses (from 50.7 billion yen to 52.0 billion yen) resulted in -1.3 billion yen in operating income. The increase is attributed to the new Impreza and Forester models and a diesel engine vehicle released last fiscal year, a multi-passenger vehicle to be released this fiscal year, Legacy to be introduced next fiscal year, and an increase in R&D expenses that support environmental measures.

In addition, deterioration of sales volume & mixture and others resulted in -0.8 billion yen. This is classified into the following three items: (1) Domestic operating income was -12.1 billion yen due to decreased sales volume of minicars and Legacy. (2) Overseas operating income was -0.6 billion yen due to deteriorated sales mixture despite increased sales volume. (3) Others impact on operating income was +11.9 billion yen.

As a result of the above, operating income decreased by 2.2 billion yen, which includes an increase of 4.6 billion yen in depreciation cost owing to the reformed taxation method. |