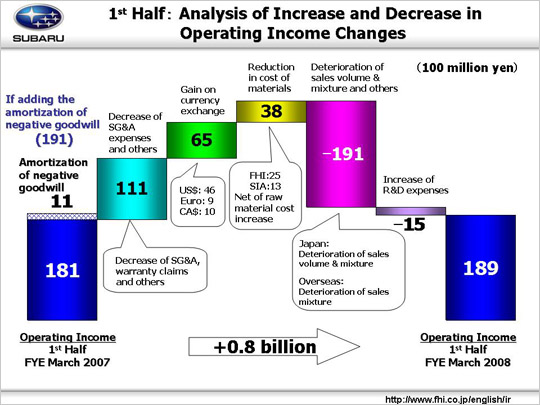

Let’s look at why the operating income went from 18.1 billion yen to 18.9 billion yen.

We gained 11.1 billion yen due to a decrease of SG&A expenses and others. This amount can be broken down into four areas. (1) An increase in fixed manufacturing costs resulted in a loss of 1.0 billion yen (-2.5 billion yen for FHI, 1.5 billion yen for SIA). This included increases in expenses for suppliers’ dies (-1.1 billion yen) and fixed processing costs (-1.4 billion yen) at FHI, and an increase in expenses for suppliers’ dies (-0.5 billion yen) at SIA which was offset by a decrease in fixed processing cost (2.0 billion yen). (2) The decrease in SG&A expenses and others resulted in a gain of 8.3 billion yen. Operating income increased 2.6 billion yen in Japan. SG&A expenses were reduced both at FHI (1.2 billion yen) and dealers (1.4 billion yen). Operating income increased 5.7 billion yen overseas due to a year-on-year reduction of $700 in per-unit incentive costs (totaling 6.1 billion yen) at SOA [$53M, from $2,500 to $1,800)]. (3) A decrease in costs associated with warranties led to a gain of 2.3 billion yen. (4) A gain of another 1.5 billion yen includes 1.3 billion yen due to foreign exchange adjustments from purchasing by overseas subsidiaries and 0.2 billion yen for other miscellaneous reasons.

We experienced an increase of 6.5 billion yen coming from foreign exchange gains. An approximate five-yen depreciation against the U.S. dollar resulted in an exchange gain of 4.6 billion yen. Shipments from FHI to its Canadian subsidiary generated an exchange gain of 1.0 billion yen due to an approximate eight-yen depreciation against the Canadian dollar. There was no exchange gain on SIA shipments to our Canadian subsidiary resulting from the conversion of the Canadian dollar against the U.S. dollar. A 0.9 billion yen exchange gain was garnered as a result of an approximate seventeen-yen depreciation against the Euro.

We gained 3.8 billion yen due to a reduction in materials cost, 2.5 billion yen at FHI and 1.3 billion yen at SIA. This includes an increase of 5.5 billion yen in material costs incurred by FHI and SIA due to a hike in steel prices and deteriorating market conditions (3.3 billion yen at FHI and 1.3 billion yen at SIA. A gross total of 5.8 billion yen at FHI and 3.5 billion yen at SIA, amounting to 9.3 billion in total.)

We lost 19.1 billion yen due to a deterioration of sales volume & mix and others. Factors leading to the profit decrease can be divided into three areas. (1) The declined sales of passenger cars in the domestic market led to a loss of 13.9 billion yen. (2) Internationally we suffered a loss of 5.0 billion yen. The sales mix deteriorated while the sales volume increased. (3) We lost 0.2 billion yen due to inventory adjustment and other factors [0.2 billion yen in unrealized inventory gains (0.2 billion yen domestically, 0 overseas), -0.4 billion yen due to declining profit at our other three internal companies etc.].

An increase in R&D expenses led to a 1.5 billion yen profit decline (from 25.1 billion yen to 26.6 billion yen). This increase in R&D expenses was related to the development of the new Forester to be launched as well as the Legacy and other models to undergo complete makeovers.

These factors combined brought operating income up 0.8 billion yen.

|