|

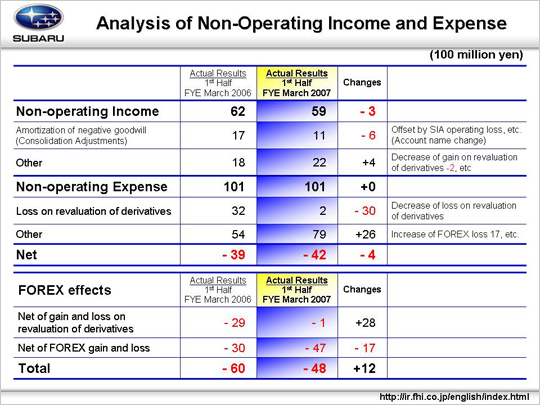

Under the non-operating account, the first half posted a loss of 0.4 billion yen from the same period last year.

The major reasons for this difference were as follows.

The amortization of negative goodwill (the consolidation adjustment account in prior period) decreased by 0.6 billion yen from 1.7 billion to 1.1 billion yen, which offset the increased burden of shared expenses with Isuzu at SIA following the retreat of Isuzu from SIA. From this year, “amortization of negative goodwill” account item has been added to financial statements, which correspond to losses related to Isuzu retreat from SIA. In addition, SIA-related amortization of negative goodwill is projected at around 1.0 billion yen in the second half, with a total of approximately 2.0 billion yen of amortization scheduled for completion during the current fiscal year.

Within the non-operating account, foreign exchange exerts the substantial effect. Derivative appraisal profits and losses consisted of a decrease in derivative revaluation profits of 0.2 billion yen included in other account of non-operating profits, and a decrease in non-operating expense derivative revaluation losses of 3.0 billion yen. This was a net gain of 2.8 billion yen, representing a profit increase over the first half of last year. Foreign exchange gains and losses, due to the difference in the sales and settlement rates (115/110 yen/dollar), resulted in a decline of 1.7 billion yen compared to the first half of last year. In total, therefore, the foreign exchange effects were a gain of 1.2 billion yen more than last year.

However, the 4.8 billion yen decline in foreign exchange effects in the first half of this year accounted for the lion’s share of the difference of 4.2 billion yen between operating income of 18.1 billion yen and ordinary income of 13.9 billion yen.

|