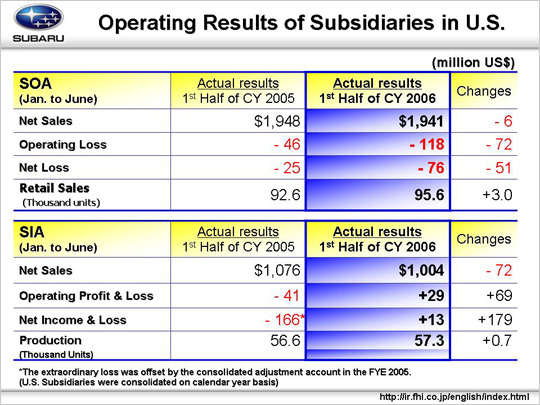

For SOA retail sales, the hot-selling Impreza and the year-long sales effects of the B9 Tribeca launched in June of last year helped offset the sluggish sales of the Legacy and Forester, with sales rising by 3 thousand units on a year-on-year basis. However, due to the need for dealer inventory adjustments, net sales finished roughly on a par with the previous year. Under operating loss, there was a decline of $4 million in the sales volume and mixture linked to the increase in low-priced models, an increase in sales promotion fees focused on the $60 million growth in incentives to sell out the 06MY, and an increase in advertising spending of $8 million. Compared to the previous year, this was a worsening of $72 million to $118 million. Net losses was down by $51 million to $76 million. SIA, meanwhile, was unable to offset the production drop in the Legacy Turbo and other models with production hikes in the B9 Tribeca, with net sales falling by $72 million. For operating profit, negative factors included the high price of precious metals, aluminum and other materials and the increase in the B9 Tribeca capital depreciation. However, with comprehensive price-cutting activities generating $38 million in savings, the elimination of losses linked to the launch of the B9 Tribeca and other steps that reduced manufacturing costs, and other moves, operating income rose by $69 million to $28 million. Net income rose by $179 million to $13 million. The main reason was the end of extraordinary losses accompanying the cancellation of leased facility contracts at the termination of consigned production occurring in March of last year and capital losses (US$196 million: reported on the consolidated settlement for the March 2005 year).

|