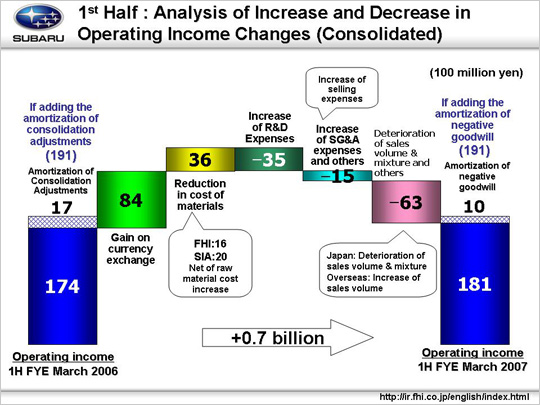

Next, further analysis of why operating income rose from 17.4 billion to 18.1 billion yen during the first half of fiscal 2007.

First, increase factors included foreign exchange gains of 8.4 billion yen. Against the U.S. dollar, a 7-yen drop in the yen generated 5.9 billion yen in gains. For the Canadian dollar, a 13-yen depreciation resulted in 1.3 billion yen in gains on shipments from Fuji Heavy Industries to the Canadian subsidiary, and 0.4 billion yen in gains on shipments from SIA to the Canadian subsidiary (in this case, due to the strength of the Canadian dollar against the U.S. dollar). The total gain was thus 1.7 billion yen. For the Euro, a decline in the yen of about 10 yen worked out to 0.8 billion yen in exchange gains.

Reductions in materials costs were 3.6 billion yen. Of this, FHI accounted for 1.6 billion yen, and SIA for the remaining 2.0 billion yen. This included an increase in materials prices, due to a hike in steel product prices and worsened raw material market conditions, of about 9.0 billion yen.

As factors detracting from income, R&D spending rose by 3.5 billion yen (from 21.6 billion to 25.1 billion yen). This was due to an increase in testing research for the Impreza, Legacy and other, which are scheduled to undergo complete model changes from the coming fiscal year.

SG&A expenses and other also grew, dragging down profits by 1.5 billion yen. These costs may be broken down into four areas: First, the reduction in fixed manufacturing costs pushed profits up by 6.9 billion yen. At FHI, this included reductions in depreciation expenses of suppliers’ die and fixed processing cost, while at SIA declines in labor expenses and other categories compensated for the increase in depreciation expenses of suppliers’ die and increased depreciation expenses. Second, the increase in sales, general and administrative expenses pushed down profits by 6.4 billion yen. Domestically, there was an increase in profits of about 2.0 billion yen, with both FHI and its dealers reducing sales, general and administrative expenses. Overseas, the figure was a loss of 8.0 billion yen, due to an increase in SOA incentives by about $800 per unit compared to last year, as well as increased advertising costs. Third, a reduction in the reversal of allowance for recalls generated losses of 0.6 billion yen. And fourth, the loss of another 1.4 billion yen in profits for other reasons.

Besides this, losses of 6.3 billion yen stemmed from the deteriorating sales volume & mixture and others. This includes a worsening of 1.0 billion yen in costs for improving safety and environmental specifications impossible to reflect in sticker prices. This can be divided into three categories. First, domestically, the impact of the decrease in passenger car sales was felt in the 7.2 billion yen drop in profits. Second, a decline overseas of 1.1 billion yen. While volume increased, the sales mix worsened. And third, inventory adjustments and other of 2.0 billion yen.

As a result, operating income increased by 0.7 billion yen for the first half year.

|