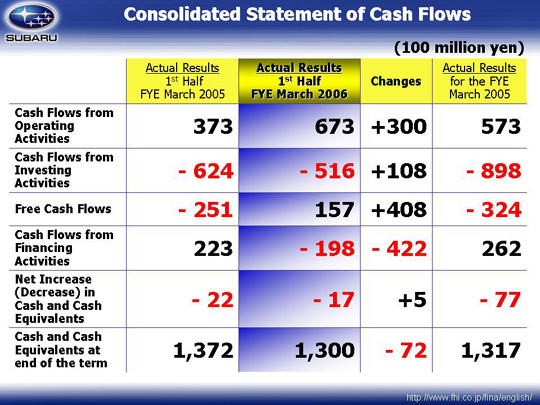

| Consolidated Statement of Cash Flows Cash flows from operating activities increased by ¥30.0 billion; however, accounts receivable decreased by ¥9.6 billion, while notes and accounts payable increased by ¥9.0 billion. There were also changes due to increasing importance of items along with some carryover. There was an increase of ¥10.0 billion of deposits received due to the extension of the leasing period for the leased vehicles. Cash flows from investing activities increased by ¥10.8 billion over the previous year. This can be attributed to the approximately ¥10.0 billion increase in purchase and proceed of marketable securities, and also purchase and proceed of investment securities, and a decrease in loans receivables of ¥6.3 billion yen which allowed for the preparation of cash on hand to be available for the share buyback in October. On the other hand, there was a gain of ¥7.0 billion in property, plant and equipment, and SIA’s settlement with Isuzu was conducted via a price adjustment on investments in subsidiaries and this caused a decrease of ¥7.1 billion. The free cash flows was ¥15.7 billion, an increase of ¥40.8 billion over the previous year. However, this was used to repay debt (short-term debt ¥19.5 billion, long-term debt ¥6.7 billion, redemption of straight bond ¥20.3 billion without straight bond issuance). There was also a shrinking of interest-bearing debt which led to cash and cash equivalents decreasing by ¥7.2 billion with the final balance at the end of term being ¥130.0 billion. |