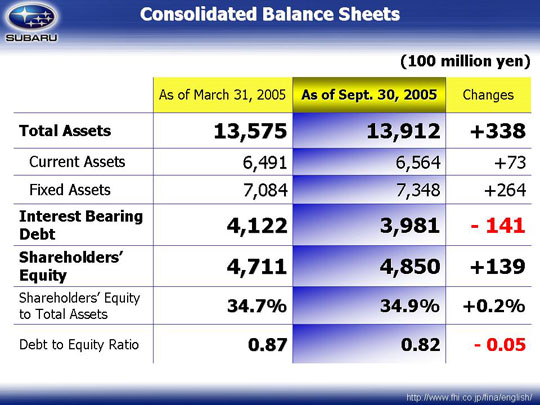

| balance sheets, at the end of September 2005, changes in current assets came about from a decrease in marketable securities and an increase in cash and time deposits due to making cash on hand available in preparation for a share buyback in October. Short-term loans fell due to reserving funds for investment in SIA. Inventories increased due to aircraft related items and SIA/SOA inventory of the B9 Tribeca. Machinery, equipment, and vehicles increased by ¥10.9 billion due to increases in the SOA lease. Other increases were partly due to the dies of suppliers for the B9 Tribeca being accounted for as assets. Regarding interest-bearing debt, ¥10.0 billion straight bond was reduced and ¥1.0 billion of commercial papers released by subsidiary, Subaru Finance Co.,Ltd., were repaid. This led to a decrease of ¥14.1 billion yen to ¥398.1 billion since March 2005. The debt-to-equity ratio was 0.82%. ¥1.7 billion related to fixed costs for SIA was amortized consolidation adjustments accounts and ¥7.1 million of the settlement with Isuzu was paid. Shareholders’ equity was ¥485.0 billion. While there was ¥3.5 billion of dividends paid, this was offset by ¥3.5 billion of accumulated earnings from companies employing in the new equity method. The current net income of ¥8.0 billion was virtually the same as the increase in retained earnings. Shareholders’ equity to total assets increased by 0.2% to 34.9%. |