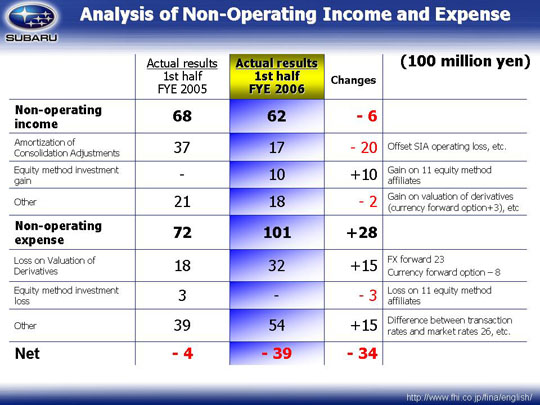

| Non-operating income and expense decreased by ¥3.4 billion year on year basis. The differences of non-operating income year on year basis were mainly that amortization of consolidation adjustments was down by ¥2 billion yen (¥3.7billion to ¥1.7 billion), and that gains on equity method affiliated and non-consolidated companies come about from profit from the eleven companies (six were new to apply equity method). The appraisal loss for non-operating income on derivatives was up by ¥1.5 billion yen and consisted of a decrease in appraisal loss on currency options of ¥0.8 billion and an increase in the appraisal loss on foreign-exchange forwards reserves of ¥2.3 billion. Other non-operating costs included losses of ¥2.6 billion yen for currency consolidation adjustment accounts so a ¥3.8 billion decrease in non-operating costs due to exchange. |