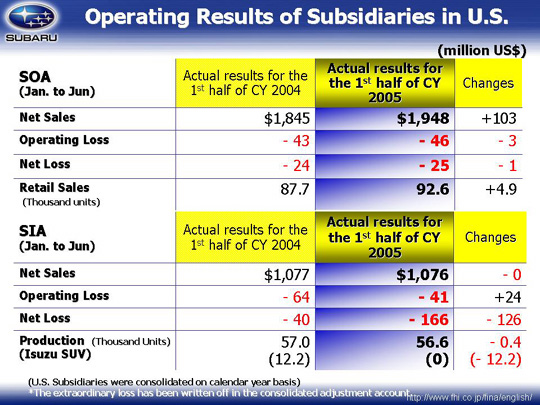

| First half of the year at SOA operation was affected by the new Legacy model and B9 Tribeca, with retail unit sales rising by 4,900 units year-on-year. This led to an increase of US$103 million in net sales compared to the same period at last fiscal year. The operating loss was due to an increase in incentives (US$1,500 to US$1,700 per unit) and increases in advertising outlay with the introduction of the B9 Tribeca (US$3 million). There was improvement in sales volume and mixture but this was not reflected in the US$46 million operating loss, which was US$3 million down from the same period of the previous year. The net loss was US$1million less than last year, at US$25 million.

At SIA, the termination of consignment production for Isuzu in July last year led to a decrease in production of 12.2 thousand units; however, this was offset by increased production of the B9 Tribeca (up by 8.3 thousand units) and the new Legacy model (up by 3.5 thousand units) which led to an actual increase of 11.8 thousand units year-on-year. There was an operating loss of US$41 million which was still an improvement of US$24 million. This was due to the improvements of the sales mixture with the introduction of the B9 Tribeca (US$28.7 million) and a decrease in the cost of materials (US$11.3 million); however, there was depreciation of the dies associated with the Legacy and B9 Tribeca (US$21.1 million). Still, there was a net loss of US$166 million (up US$ ¥126 million) due to extraordinary losses associated with the termination of leases for equipment due to the termination of consignment production. This extraordinary loss has been written off in the consolidation adjustment account for the fiscal year ended March 2005. |