|

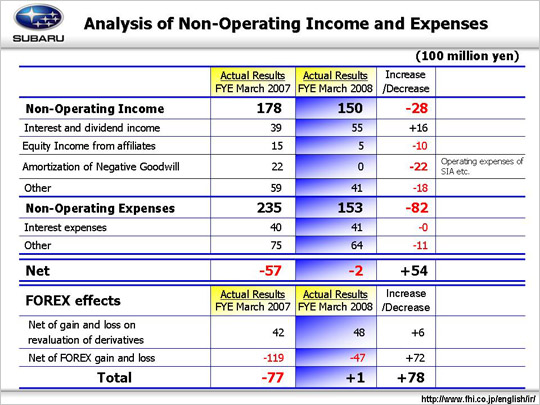

Net non-operating income and expenses increased by 5.4 billion yen year on year.

The major factor affecting non-operating income decrease was 2.2 billion yen of amortization of negative goodwill, which accounted fiscal year ended March 2007, offset SIA's increased fixed cost for joint facilities after Isuzu's withdrawal.

Foreign currency exchange effects had the greatest impact on net non-operating income and expense. The exchange impact includes two items, namely (1) gain and loss on revaluation of derivatives and (2) FOREX gain and loss. Compared with the preceding year, (1) gain and loss on revaluation of derivatives for the fiscal year ended March 31, 2007 include an increased gain of 4.3 billion yen on revaluation of derivatives and an increased loss of 0.1 billion yen on revaluation of derivatives in non-operating expense, resulting in a net increase of 4.2 billion yen.

The fiscal year ended March 31, 2008 had 4.9 billion yen of gain on revaluation of derivatives and 0.1 billion yen of loss on revaluation of derivatives, resulting in a net increase of 4.8 billion yen, which is 0.6 billion greater than the previous fiscal year. (2) Meanwhile, FOREX had a loss of 4.7 billion yen due to the difference in market and hedge rate, which is a 7.2 billion yen improvement from -11.9 billion yen for the corresponding period a year earlier. In total, FOREX effects increased by 7.8 billion yen year on year.

Net non-operating income and expenses were -0.2 billion yen, which led the difference between operating income amounted to 45.7 billion yen and ordinary income amounted to 45.4 billion yen.

|