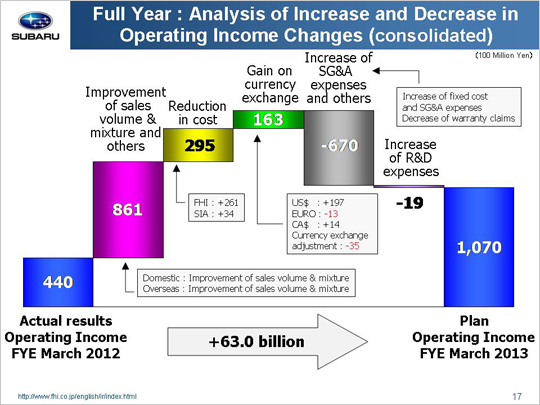

| Now let's look at the factors behind the projected year on year 63.0 billion yen increase in operating income that will take us from 44.0 billion yen to 107.0 billion yen. The primary reason for the increase in operating income will be a gain of 86.1 billion yen due to sales mix variances. This gain can be broken down into the following three areas. First off there will be a gain of 21.3 billion yen from rising domestic sales of new models. Increasing sales of passenger vehicles will drive profits up further. Next, we will see a gain of 34.8 billion yen from the sale of new models in overseas markets. Steady sales in the U.S. will boost sales for this fiscal year far above what they were last year when the March 11 earthquake put the brakes on both production and sales. Finally, we expect a gain of 30.0 billion yen due to inventory adjustments and others. Another factor behind the expected increase in operating income will be a gain of 29.5 billion yen resulting from cost cuts. This includes a gain of 26.1 billion yen generated by FHI as well as a gain of 3.4 billion yen coming from SIA. FHI is expected to generate a gain of 16.1 billion yen through cost cuts and a gain of 10.0 billion yen due to lower materials costs and other positive market factors. SIA will also generate a gain of 3.6 billion yen due to cost cuts and a loss of 0.2 billion yen as a result of higher materials costs. Another contributing factor that will bring operating income up is a foreign exchange gain of 16.3 billion yen. This includes a gain of 19.7 billion yen due to an approximate 3 yen depreciation against the U.S. dollar, a loss of 1.3 billion yen due to an approximate 2 yen appreciation against the euro, and a gain of 1.4 billion yen due to an approximate 4 yen depreciation against the Canadian dollar. This figure also includes a loss of 3.5 billion yen due to foreign exchange adjustments for transactions between FHI and its overseas subsidiaries. The primary reason for the decline in operating income will be a loss of 67.0 billion yen due to increases in SG&A expenses. This loss can be broken down into the following three areas. First, we will see a loss of 32.2 billion yen due to an increase in fixed manufacturing costs. This includes a loss of 30.0 billion yen coming from FHI as well as a loss of 2.2 billion yen at SIA. FHI is expected to generate a loss of 12.8 billion yen due to higher costs for suppliers' dies resulting from a series of new car launches. It is also expected to post a loss of 17.2 billion yen due to higher fixed processing costs associated with increased operations on top of increased costs needed for R&D as well as to boost production capacity. SIA is expected to lose 1.3 billion yen due to higher costs for suppliers' dies and 0.9 billion yen due to an increase in fixed processing costs. Next we will see a loss of 37.5 billion yen due to an increase in SG&A expenses. We expect that SG&A expenses will be much higher than last fiscal year since we held back on advertising after the March 11 earthquake and also because of a hike in expenses related to growing sales volumes. This loss will include a loss of 9.1 billion yen at FHI, a loss of 0.3 billion yen at domestic dealers, a loss of 13.5 billion yen at SOA, a loss of 1.3 billion yen at our Canadian subsidiaries, and a loss of 13.3 billion yen coming from other operations. The third factor includes a decrease in costs associated with warranty claims that will lead to a gain of 2.7 billion yen. Finally, an increase in R&D expenses is expected to result in a loss of 1.9 billion yen. All these factors combined will bring consolidated operating income for the fiscal year ending March 2013 up 63.0 billion yen year on year to total 107.0 billion yen. |