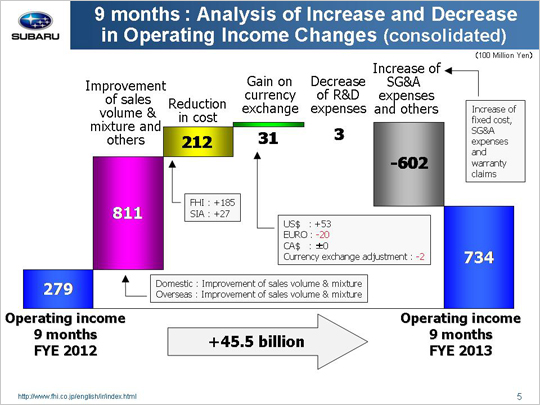

| Let’s look at the reasons behind the year-on-year increase of 45.5 billion yen in operating income that went from 27.9 billion yen to 73.4 billion yen. The primary reason for the increase in operating income was a gain of 81.1 billion yen due to good sales mix variances. This gain can be broken down into the following three areas. First, we saw a gain of 17.1 billion yen in domestic new car sales. Although minicar sales fell, increased sales of passenger vehicles such as the Impreza and the BRZ drove overall domestic sales up. Next, we saw a gain of 31.9 billion yen in overseas new car sales. Robust sales of the Impreza resulted in a significant sales increase over the previous year when the March 11 earthquake put a damper on production and sales during the first fiscal half. Then finally, we had a gain of 32.1 billion yen due to inventory adjustments and others. Another factor behind the jump in operating income was a gain of 21.2 billion yen related to material costs. This includes a gain of 18.5 billion yen generated by FHI as well as a gain of 2.7 billion yen coming from SIA. FHI generated a gain of 12.5 billion yen from cost reductions and another gain of 6.0 billion yen due to lower material prices and better market conditions. SIA yielded a gain of 2.4 billion yen through cost reductions and a gain of 0.3 billion yen due to materials prices, etc. Another contributing factor that brought operating income up was a foreign exchange gain of 3.1 billion yen. This includes a gain of 5.3 billion yen due to an approximate 1 yen depreciation against the U.S. dollar, and a loss of 2.0 billion yen due to an approximate 7 yen appreciation against the euro. The exchange rate for the Canadian dollar remained almost the same as last year, resulting in neither a gain nor loss. This figure also includes a loss of 0.2 billion yen due to foreign exchange adjustments for transactions between FHI and its overseas subsidiaries. Finally, a reduction in R&D expenses resulted in a gain of 0.3 billion yen. The main factor bringing operating income down was a loss of 60.2 billion yen due to increases in SG&A expenses. This loss can be broken down into the following three areas. First, we see that an increase in fixed manufacturing costs generated a loss of 27.1 billion yen, with a loss of 25.1 billion yen coming from FHI and another loss of 2.0 billion yen at SIA. FHI generated a loss of 10.0 billion yen due to increased costs for suppliers’ dies and a loss of 15.1 billion yen due to higher fixed processing costs. SIA lost 1.0 billion yen due to higher costs for suppliers’ dies and 1.0 billion yen due to an increase in fixed processing costs. Next we see that an increase in SG&A expenses led to a loss of 31.3 billion yen. FHI experienced a loss of 7.0 billion yen due to higher costs associated with increasing sales volume as well as an increase in SG&A expenses over the same period last year when SG&A expenses declined in the wake of the March 11 earthquake. The 31.3 billion yen loss also includes a loss of 0.2 billion yen at domestic dealers, a loss of 12.2 billion yen generated at SOA from higher sales promotion costs associated with the increasing sales volume, a loss of 1.5 billion yen at our Canadian subsidiaries, and a loss of 10.4 billion yen from other operations. The third and last factor includes an increase in costs associated with warranty claims that led to a loss of 1.8 billion yen. These factors combined brought consolidated operating income for the first nine months of the fiscal year ending March 2013 up 45.5 billion yen to total 73.4 billion yen. |