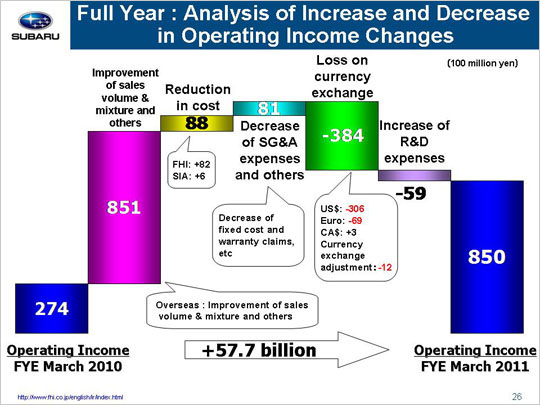

Now let’s look at the reasons for the projected year-on-year increase and decrease in operating income that takes us from 27.4 billion yen to 85.0 billion yen.

The factors that will lead to the increase in operating income include a gain of 85.1 billion yen due to an improvement of sales volume and mixture and others. This gain can be broken down into three areas. First, we expect to see a loss of 10.1 billion yen in the domestic market due to a decrease in sales volumes as a result of the termination of the eco-car purchase subsidy programs. Next, we will see a gain of 87.8 billion yen in overseas markets thanks to across-the-board sales volume increases. Finally, we expect a gain of 7.4 billion yen due to inventory adjustments and others.

Cost in reduction will generate a gain of 8.8 billion yen, including a gain of 8.2 billion yen at FHI and a gain of 0.6 billion yen (6 million dollars) at SIA. FHI is expected to generate a gain of 21.6 billion yen with losses amounting to 13.4 billion yen due to increased materials costs and other adverse market factors. SIA is expected to generate a gain of 7.6 billion yen (82 million dollars) and a loss of 7.0 billion yen (76 million dollars) related to rising material prices and other unfavorable market conditions.

A decrease in SG&A expenses, etc.. will lead to a gain of 8.1 billion yen. This amount can also be broken down into three areas. The first is a reduction in fixed manufacturing costs that will reap gains totaling 7.9 billion yen, including a gain of 8.5 billion yen at FHI and a loss of 0.6 billion yen (7 million dollars) at SIA. FHI will yield a gain of 6.1 billion yen due to the depreciation for suppliers’ dies and a gain of 2.4 billion yen due to lower fixed processing costs. SIA is expected to gain 1.2 billion yen (12 million dollars) due to the depreciation for suppliers’ dies and lose 1.8 billion yen (19 million dollars) due to increased fixed processing costs. The second area encompasses an increase in SG&A expenses, which is projected to yield a total loss of 4.7 billion yen. FHI is expected to generate a loss of 5.2 billion yen due to transportation and packing costs that have risen in tandem with the increasing sales volume. Domestic dealers will post a gain of 3.9 billion yen due to efforts to lower SG&A expenses. SOA, on the other hand, will see a loss of 1.7 billion yen (19 million dollars), which will include a gain of 2.4 billion yen (27 million dollars) due to reduced advertising as well as SG&A expenses and a loss of 4.1 billion yen (46 million dollars) due to increased incentives. Although the per-unit incentive is expected to be cut by approximately 50 dollars, down from 1,100 dollars for the previous fiscal year to 1,050 dollars for the current fiscal year, the total amount of incentives will rise due to an increase in sales volumes. Our Canadian subsidiary is expected to see a loss of 1.2 billion yen due to an increased incentives, etc.. while our other subsidiaries will experience combined losses of 0.5 billion yen. Finally, a decrease in costs associated with warranty claims will lead to a gain of 4.9 billion yen.

Operating income will drop 38.4 billion yen due to foreign exchange losses. This includes a projected loss of 30.6 billion yen due to an approximate 7 yen appreciation against the U.S. dollar, a projected loss of 6.9 billion yen due to an approximate 19 yen appreciation against the euro, and a projected gain of 0.3 billion yen coming from the exchange rate for the Canadian dollar which is expected to remain flat. This figure also includes a loss of 1.2 billion yen due to foreign exchange adjustments for transactions between FHI and its overseas subsidiaries.

Development of new models and more environmentally friendly features will send R&D expenses up from 37.2 billion yen to 43.1 billion yen, resulting in a loss of 5.9 billion yen.

These factors combined are expected to bring operating income up 57.7 billion yen. |