|

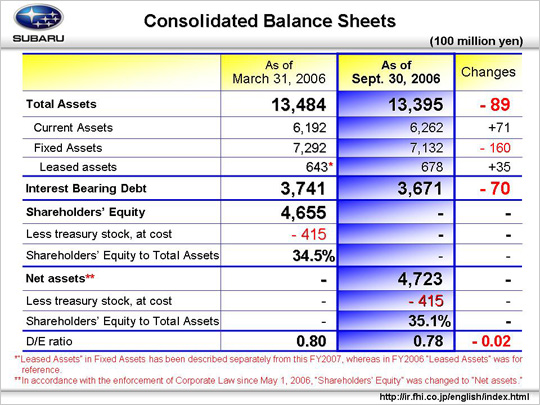

Next, we come to the balance sheet. Total assets are 1,339.5 billion yen, an increase of 8.9 billion yen from the end of the previous fiscal year.

Current assets increased by 7.1 billion yen with the main reason for that being growth in inventory assets. This resulted from the increase of work in progress for the Boeing 787 and AH 64D, seasonal increase of domestic Automobile inventory, and the increase of SOA inventory.

Fixed assets decreased by 16 billion yen. The major reason for this was the depreciation of tool and die following the new model launch at SIA.

From this fiscal year, meanwhile, a line item for leased assets has been added to the balance sheet. This item was extracted from the line item of machinery, equipment, vehicles and other fixed assets in the FYE March 2006. The figure for the FYE March 2006 is presented as a reference.

For interest-bearing debt, a 20 billion yen bond was redeemed, while a new 20 billion yen bond was issued. As such, there was no change in the corporate bond amount. Besides this, with both short-term and long-term borrowings being paid down, total interest-bearing debt was 367.1 billion yen, a decline of 7.0 billion yen from the same period the previous year. The debt-to-equity ratio was 0.78.

For negative goodwill (the consolidation adjustments account in prior period), 1.0 billion yen was amortized in connection to the SIA fixed cost burden. For Isuzu-related amortization, the remaining 1.0 billion yen is scheduled to the amortized during the current fiscal year.

Accompanying the enactment of the Corporate Law, the “equity section” of the balance sheet is now referred to as the “net asset section.” This has also resulted in minority shareholdings being included in the net asset section, which totaled 472.3 billion yen. The capital adequacy ratio, which expresses the share of net assets to total assets excluding the minority equity, has risen by 0.6 points to the 35.1% level.

|