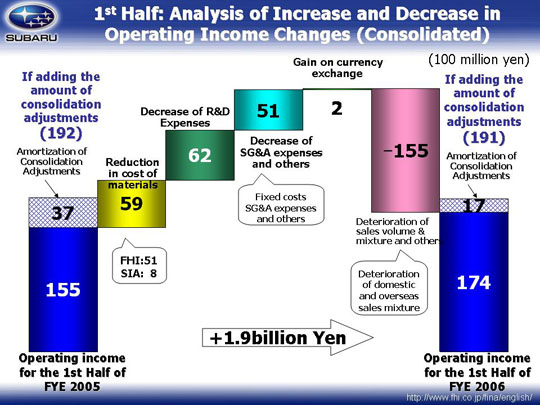

Moving on, the reasons for the change in operating income from ¥15.5 billion to ¥17.4 billion.

Income increased due to a ¥5.9 billion reduction in the cost of materials which was made up of a decrease of ¥5.1 billion from Fuji Heavy Industries Ltd (FHI) and ¥0.8 billion from Subaru of Indiana Automotive Inc (SIA). Estimates at the beginning of the period predicted a decrease of ¥4.1 billion from FHI and an increase of ¥0.7 billion at SIA for a total reduction of ¥3.4 billion; however, the lessening effect of soaring material price at SIA and efforts put into reducing the cost of materials along with the speeding up of cost reductions at FHI had a positive effect.

R&D costs were down by ¥6.2 billion from ¥27.8 billion to ¥21.6 billion. This reflected not only the completion of the B9 Tribeca model R&D and a new platform putting on hold, but also R&D on the new-model minicar, to be introduced in the next fiscal year, and the FMC of the Impreza is conducted efficiently.

Overhead costs decreased by ¥5.1 billion, with fixed manufacturing costs down by ¥4.0 billion. Fixed costs rose due to the release of new models at SIA and increase in the depreciation of the dies for the new Legacy and B9 Tribeca; however, they are being offset by reductions in the depreciation of the dies for the Legacy at FHI. Sales and administration costs have decreased by ¥0.7 billion. This is because costs associated with FHI and advertising and sales incentives at domestic dealers have been reduced markedly.

Conversely, incentive and advertising costs at SOA have increased. There has also been an increase, to ¥0.9 billion, in costs associated with warranty (loss from reversal in allowance for recalls), with the remainder being found in other areas.

Currency exchange has remained level with the approximately one yen rise in the yen against the US dollar being offset by rise in the Canadian dollar. Exchange losses from the US dollar amounted to ¥1.1 billion while there were gains of ¥0.1 billion from the euro and ¥1.2 billion from the Canadian dollar.

Causes for the decrease in income stem from the ¥15.5 billion yen deterioration of sales volume and mixture. Japan saw a decrease of ¥6.4 billion. The decreasing sale of units was centered largely on the R2, with the deterioration of sales mixture surrounding the Legacy also having an effect. Costs associated with improving environmental and safety requirements could not be transferred to the sales price, but it also includes an approximately ¥6.0 billion cost associated with FHI shipments. Inventory adjustments and others caused a decrease of ¥1.0 billion.

This all led to an operating income of ¥1.9 billion.

|