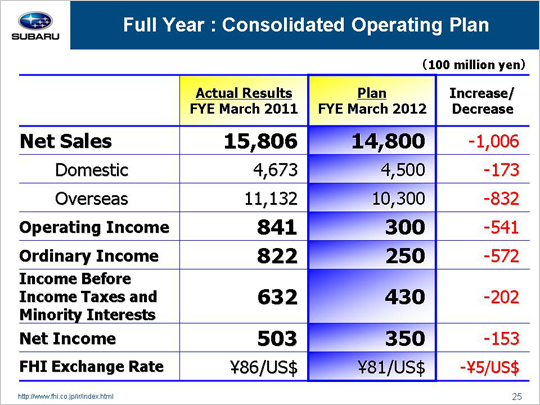

Net sales will decline 100.6 billion yen, or 6.4%, year on year to total 1,480 billion yen. We project a 45.1 billion yen foreign exchange loss due to the strong yen and a 58.1 billion yen loss due to an unfavorable sales mix despite a 2.6 billion yen gain at our three internal companies and other operations.

Operating income is projected to total 30.0 billion yen, down 54.1 billion yen, or 64.3%, year on year. Factors behind this decline include an unfavorable sales mix variance due to a decrease in sales volume, foreign exchange losses resulting from the strong yen, and increased R&D expenses, which will fail to be offset by gains from reductions in SG&A expenses. Further details will be provided later on.

Ordinary income is projected to total 25.0 billion yen, down 57.2 billion yen, or 69.6%, year on year.

Earnings before income taxes and minority interests will fall 20.2 billion yen, or 32.0%, to reach 43.0 billion yen. We do not expect any major impact on our bottom line other than the gain on the sale of the Subaru Building and the loss on disaster posted during the first quarter.

Net income will amount to 35.0 billion yen, for a drop of 15.3 billion yen, or 30.5%, due to tax expenses related to our subsidiaries, etc.

|