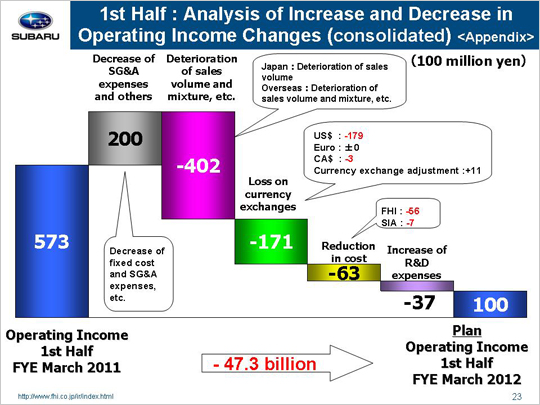

| Now let’s look at the reasons for the projected year-on-year 47.3 billion yen decrease in operating income that will take us from 57.3 billion yen to 10.0 billion yen. The main factor to push operating income up will be a gain of 20.0 billion yen from reductions in SG&A expenses. This gain can be broken down into the following three areas. (1) A gain of 9.5 billion yen in fixed manufacturing costs will come from a gain of 8.1 billion yen at FHI and a gain of 1.4 billion yen at SIA. FHI will generate a gain of 4.5 billion yen due to cost cuts for suppliers’ dies and a gain of 3.6 billion yen due to lower fixed processing costs. SIA will gain 1.5 billion yen from reduced processing costs while increased expenses for suppliers’ dies are expected to yield a loss of 0.1 billion yen. Next we expect to see a gain of 9.2 billion yen from reductions in SG&A expenses. This gain will include a gain of 6.3 billion yen at FHI, a gain of 1.4 billion yen at domestic dealers, a gain of 2.9 billion yen at SOA, and a loss of 1.4 billion yen from other operations. SOA will see a loss of 0.9 billion yen due to advertising costs but generate a gain of 3.8 billion yen due to a 250 dollar drop in the per-unit rebate. The drop will bring the 950 dollar cash-back incentive for the first half (April through September) of 2010 down to 700 dollars for the same period in 2011. Finally, the third factor includes a decrease in costs associated with warranty claims that will result in a gain of 1.3 billion yen. The main factor that will lead to a decrease in operating income will be a loss of 40.2 billion yen due to a poor sales mix. This loss can be broken down into the following three areas. We will see a loss of 10.7 billion yen in domestic operations and another loss of 36.9 billion yen in overseas operations. Finally, we expect a gain of 7.4 billion yen due to inventory adjustments. Another factor to bring our operating income down will be a likely foreign exchange loss of 17.1 billion yen. This includes a projected loss of 17.9 billion yen due to an approximate 9 yen appreciation against the U.S. dollar as the exchange rate for the euro remains unchanged at 116 yen. We also see a projected loss of 0.3 billion yen due to an approximate 2 yen appreciation against the Canadian dollar. We expect a gain of 1.1 billion yen due to foreign exchange adjustments for transactions between FHI and its overseas subsidiaries. Despite lower material costs, we expect to see an overall loss of 6.3 billion yen, with a loss of 5.6 billion yen at FHI and a loss of 0.7 billion yen at SIA. FHI is expected to generate a loss of 5.6 billion yen due to increased material prices, etc. SIA will see a gain of 1.2 billion yen due to a reduction in costs while rising raw material prices will lead to a loss of 1.9 billion yen. Increasing R&D expenses is expected to result in an overall loss of 3.7 billion yen. These factors combined should bring operating income for the first fiscal half down 47.3 billion yen for a total 10.0 billion yen. |