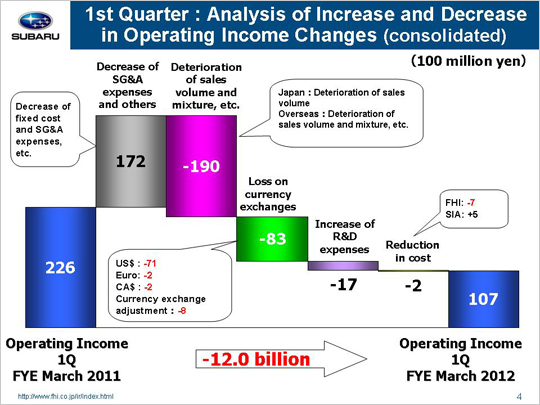

| Now let’s look at the factors behind the12.0 billion yen year-on-year drop that saw operating income fall from 22.6 billion yen to 10.7 billion yen. The primary reason for the increase in operating income was a gain of 17.2 billion yen due to reduced SG&A expenses. This gain can be broken down into the following three areas. First, we see that a reduction in fixed manufacturing costs generated a gain of 6.8 billion yen, with a gain of 5.3 billion yen coming from FHI and another gain of 1.5 billion yen at SIA. FHI yielded a gain of 2.8 billion yen due to cost cuts for suppliers’ dies and a gain of 2.5 billion yen due to lower fixed processing costs. SIA gained 0.2 billion yen due to cost cuts for suppliers’ dies and 1.3 billion yen due to a reduction in fixed processing costs. Next we see that a drop in SG&A expenses produced a gain totaling 8.4 billion yen. FHI generated a gain of 3.1 billion yen due to reduced advertising, transportation, and packing costs. Domestic dealers also generated 0.5 billion yen as a result of their efforts to cut SG&A expenses. SOA yielded a gain of 3.9 billion yen. While our Canadian subsidiary generated a loss of 0.2 billion yen, our other subsidiaries saw combined gains totaling 1.1 billion yen. The figure for SOA includes a gain of 0.7 billion yen due to reduced advertising costs, etc. in addition to a gain of 3.2 billion yen. This latter gain comes from an approximate 550 dollar drop in the per-unit rebate that brought the 1,050 dollar cash-back incentive for April through June 2010 down to 500 dollars for April through June 2011. Finally, the third factor includes a decrease in costs associated with warranty claims that led to a gain of 2.0 billion yen. Major factors leading to the profit downturn included a loss of 19.0 billion yen due to unhealthy sales mix variances. This loss can be broken down into the following three areas. First we saw a loss of 0.2 billion yen in domestic operations. Although the sales mix improved once we began filling our order backlog for passenger cars, the declining sales volume had a major impact on performance. Next, our overseas operations generated a loss of 26.8 billion yen due to production and shipment declines following on the heels of the devastating earthquake. Finally, among these losses we did realize a gain of 8.0 billion yen due to inventory adjustments. Another contributing factor that brought operating income down was a foreign exchange loss of 8.3 billion yen. This included a loss of 7.1 billion yen due to an approximate 10 yen appreciation against the U.S. dollar, a loss of 0.2 billion yen due to an approximate 4 yen appreciation against the euro, and a loss of 0.2 billion yen due to an approximate 2 yen appreciation against the Canadian dollar. A loss of 0.8 billion yen was seen due to foreign exchange adjustments for transactions between FHI and its overseas subsidiaries. Increases in R&D expenses resulted in a loss of 1.7 billion yen. Despite efforts to reduce material costs, we saw an overall loss of 0.2 billion yen, with a loss of 0.7 billion yen at FHI and a gain of 0.5 billion yen at SIA. While FHI generated a gain of 2.0 billion yen from reduced material costs, it experienced a loss of 2.7 billion yen due to hikes in material prices, etc. SIA gained 1.2 billion yen from reduced material costs but lost 0.7 billion yen due to adverse market conditions of raw materials. These factors combined brought first quarter operating income down 12.0 billion yen to total 10.7 billion yen. |